Please excuse me for not posting regularly. The basic explanation is that I do try improve the service and I’m delayed by the server admin. Me believes come with the actual improvement which in reality become just small step forward.

In this episode I have make my interpretation of the knowledge given to me or pas on me;

Aggregate economic activity is represented by not only real inflation-adjusted gross domestic product (GDP) which is a measure of aggregate output but also by the aggregate measures of industrial production: employment, income, and sales. These are the key coincident economic indicators used for the official determination of U.S. business cycle peak and trough dates. Business cycles aren't just about businesses. They reflect the entire economy and can have a significant impact on your personal life, your plans, and your approach to saving, investing, or spending. Business cycles occur in expansions followed by contractions.

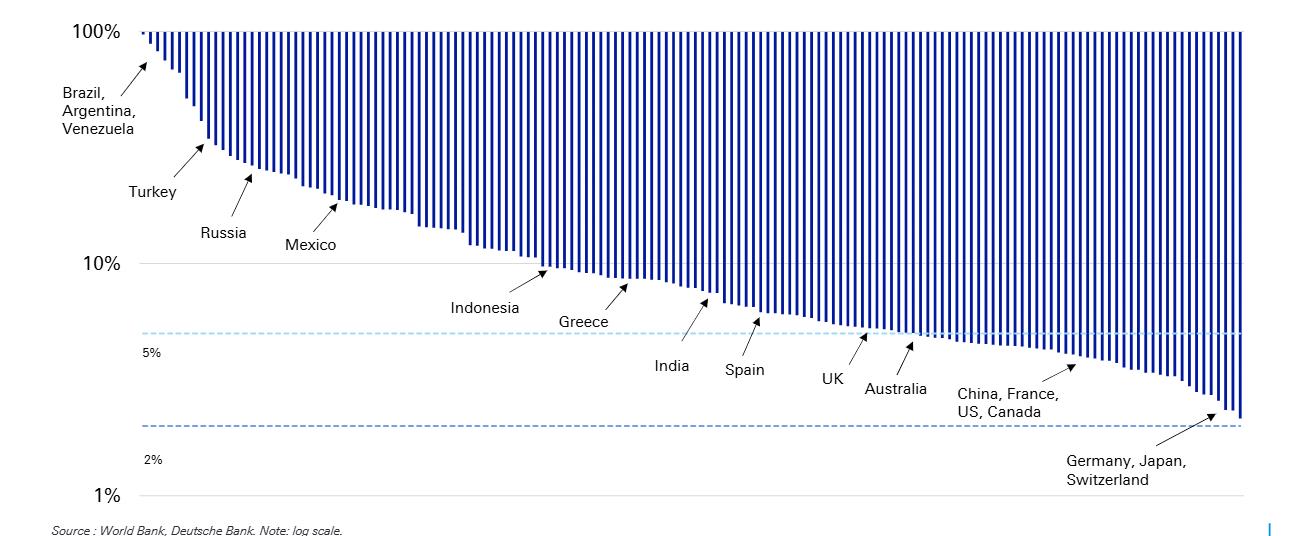

Here comes the trick! Fiat currency not backed by a physical commodity like gold, relies on government backing as supply-demand dynamics. Most modern currencies, such as the U.S. dollar and euro, fall into this category. That money as currency is subject to fiscal policies with certain outcome deriving from greedy Governments. This subject matter of the greed is focused on 2% inflation given to Central Banks of each country to manage as manipulate to keep economies running smoothly. (click on the image to the left) Average annual inflation of 152 countries since 1971 when the Bretton Woods system collapsed. No country has averaged less than 2% inflation but Switzerland at 2.2% comes closest. Meantime Government decided that any revenue shortage as deficit be finances by/on DEBT deriving from auctioned of bonds as coupons and bill. At the very same time the greedy GOV since US President Richard Nixon's decision to suspend US dollar convertibility to gold in 1971, and then system of national fiat currencies has been used globally over the sudden imposing hidden inflation tax on each and every nation.

Fiat currency not backed by a physical commodity like gold, relies on government backing as supply-demand dynamics. Most modern currencies, such as the U.S. dollar and euro, fall into this category. That money as currency is subject to fiscal policies with certain outcome deriving from greedy Governments. This subject matter of the greed is focused on 2% inflation given to Central Banks of each country to manage as manipulate to keep economies running smoothly. (click on the image to the left) Average annual inflation of 152 countries since 1971 when the Bretton Woods system collapsed. No country has averaged less than 2% inflation but Switzerland at 2.2% comes closest. Meantime Government decided that any revenue shortage as deficit be finances by/on DEBT deriving from auctioned of bonds as coupons and bill. At the very same time the greedy GOV since US President Richard Nixon's decision to suspend US dollar convertibility to gold in 1971, and then system of national fiat currencies has been used globally over the sudden imposing hidden inflation tax on each and every nation.

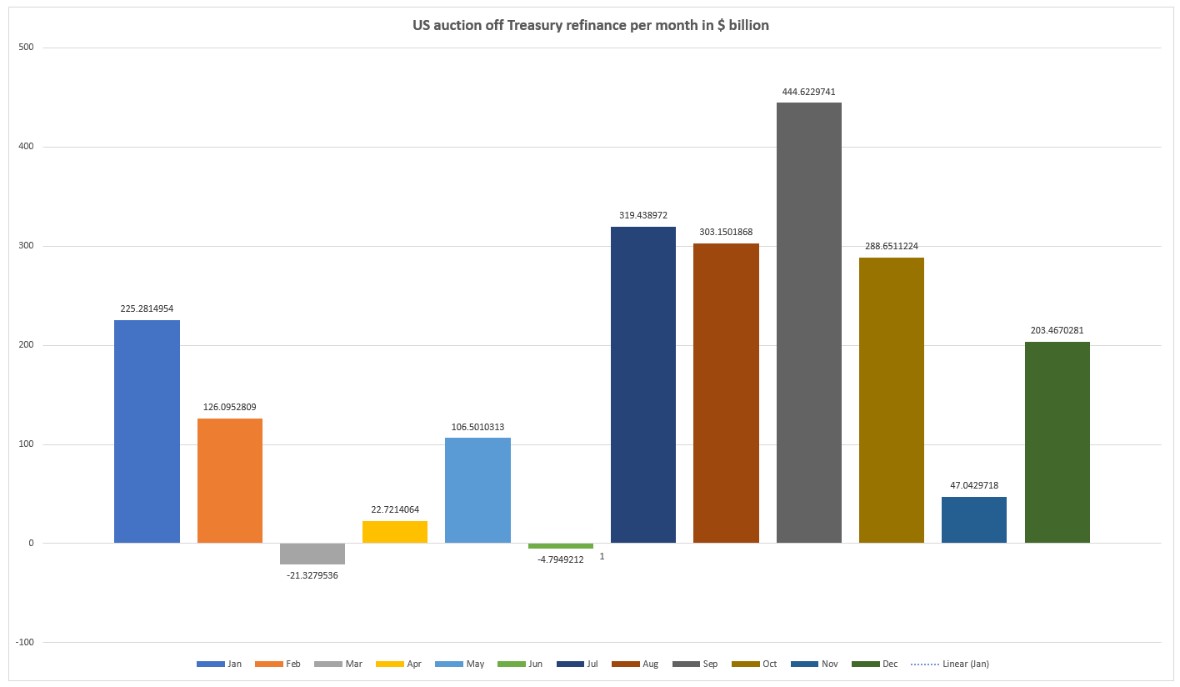

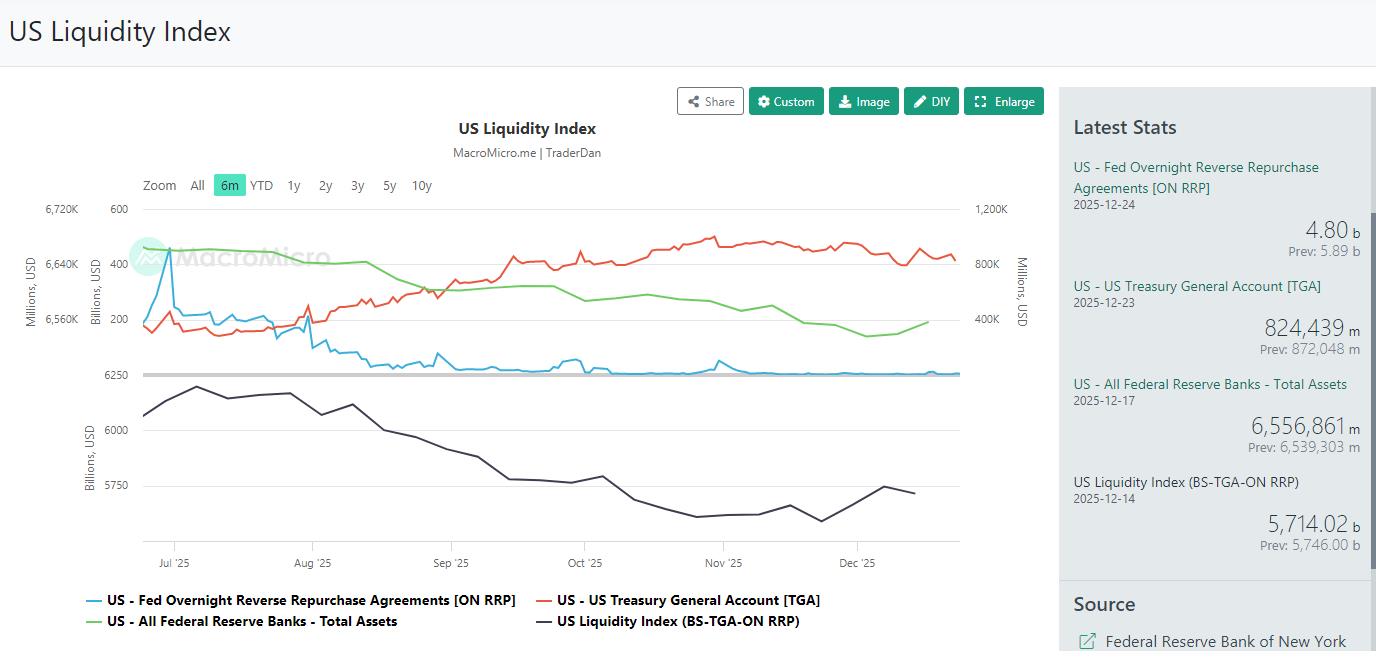

Basically, GOV decide never to pay the National DEBT as only pay the servicing fees on each nation debt serviced from the bond as bills and coupons with conversion on maturity dates of such national debt with newly auctioned-off debt at new thereafter inflation value. Old debt on maturity day be/is payoff with newly auctioned-off debt. In this form the national DEBT is rising and only inflated to the value of the old debt. For example, during 2025 budget in US Scott Bessent reduce the US National Debt at 3% core inflation as $1,125trillion of old value to new worth US GDP. Such maneuverer does allow for the US GOV create gap in GDP by lowering its obligation so the Primary Dealers will come-up with new cash on hand and invest in newly auctioned-off US Bond. The paradox come at the point as US GOV borrow more the privet sector so the market liquidity is tide to US GOV obligation never repaid and the market facing slow decay. Chair Powell’s Press Conference December 10, 2025 stated that Fed will purchase short-dated Treasury bills to help manage cash levels however this is only a partial story on the liquidity issue. Thereafter July 18, 2025, President Trump signed into law the Guiding and Establishing National Innovation for US Stablecoins Act (the GENIUS Act), allowing for registered financials institution to issue unlimited number of Stablecoins. Upon that action the gap in US debt to GDP improve and US Treasury were able to auction off bills and coupons to stabilize the US economy regardless as what any of the foreigner entity decide to short these holdings. This temporary gimmick will and were allowing Scott Bessent to refinance pressures compound the problem of fiscal management. By the end of 2025, about a third of marketable debt, worth US$9.2 trillion, that have matured, with a further US$9 trillion maturing in 2026 if not the Fed statement dated December 10, 2025. (click on image to the left)

Chair Powell’s Press Conference December 10, 2025 stated that Fed will purchase short-dated Treasury bills to help manage cash levels however this is only a partial story on the liquidity issue. Thereafter July 18, 2025, President Trump signed into law the Guiding and Establishing National Innovation for US Stablecoins Act (the GENIUS Act), allowing for registered financials institution to issue unlimited number of Stablecoins. Upon that action the gap in US debt to GDP improve and US Treasury were able to auction off bills and coupons to stabilize the US economy regardless as what any of the foreigner entity decide to short these holdings. This temporary gimmick will and were allowing Scott Bessent to refinance pressures compound the problem of fiscal management. By the end of 2025, about a third of marketable debt, worth US$9.2 trillion, that have matured, with a further US$9 trillion maturing in 2026 if not the Fed statement dated December 10, 2025. (click on image to the left)

On December 2025 FED were force to further QE as short-term bills in amount of 40 billion per month so in December 2025 the Stablecoins gimmick allowed for US Treasury to sell (auction off) $830 billion in GOV bonds as of what $203,46 billion in newly treasuries as deficit cover. Treasury at the very same time jump to cover inflation as its core at 2.6% with no data for October 2025 while liquidity downturn position.

US affordability crisis is pushing people to work multiple jobs. The number of multiple jobholders hit 9.3 million in November 2025, an all-time high. This now exceeds the Great Financial Crisis peak by 1.2 million. As a % of employment, this stands at 5.8%, near the highest level this century. This is not a strong economy or a strong job market. Major technological breakthroughs have repeatedly produced asset bubbles. Bubbles form when investors believe a technology will create a transformative future, despite HIGH UNCERTAINTY around timing and magnitude. Professional investor sentiment jumped to 7.4 in December, the highest level in 4.5 years. Market sentiment is approaching bubble-like euphoria levels. In this environment Donald Trump impeachment warning were issued by Mike Johnson the speaker of the US House. “As Republican infighting continues and President Trump’s approval ratings continue to plummet, House Speaker Mike Johnson is making a desperate plea to voters He continued his warning, invoking the late head of TPUSA and conservative podcaster Charlie Kirk to encourage voters to head to the polls next year” With the new year looming, Republicans and Democrats are gearing up for the 2026 midterm elections. As Republican infighting continues and President Trump’s approval ratings continue to plummet, House Speaker Mike Johnson is making a desperate plea to voters. The Louisiana Republican appeared at the Turning Point USA summit in Phoenix, Arizona, on Sunday, warning his followers about the potential repercussions if Democrats regain power. “I want to leave you with three things. If we refuse to let the left and the mainstream media lie without being challenged, if we refuse to let outside forces divide us… and if we all will do as Charlie did — and that is fight like happy warriors, advance his principles and adopt his approach — we will win next year and we will save the greatest nation in the history of the world,” he said. But as what he did not mention goes as follow.

The ISM Manufacturing Employment Index in US fell to 44.0 level on December 2025, the lowest in 3 months - the 10th consecutive monthly contraction. This decline now signals accelerating fallout across US manufacturing payroll employment.

US small firms shed -120,000 jobs in November 2025, the most since the 2020 Crisis. This was the 6th monthly decline over the last 7 months, during which small firm’s employment fell by -264,000. US employers announced 1,170,821 job cuts in 2025, the 2nd-highest in 16 years. In November 2025, firms announced 71,321 job cuts, a level exceeded only twice since the Financial Crisis. The number of Americans employed part-time for economic reasons rose nearly 1 million in Oct and Nov, to 5.5 million in 2025, the highest since March 2021. This measures workers who want full-time jobs but cannot get them, usually because hours were cut or full-time work is unavailable. They are counted as employed, but they signal hidden weakness in the labor market. As a % of labor force, this gauge spiked to 3.2%, consistent with recession levels. Is the US economy set to see a 6% unemployment rate? The difference between the share of Americans saying jobs is “hard to get” versus “plentiful” fell to 5.9%, the lowest in 4 years, the Conference Board asks consumers about job market conditions each month. This is a leading indicator for the lagging unemployment rate, as consumers experience the job market in real time, this suggests a further rise in the jobless rate, potentially as high as 6% and forward indicators are flashing red.

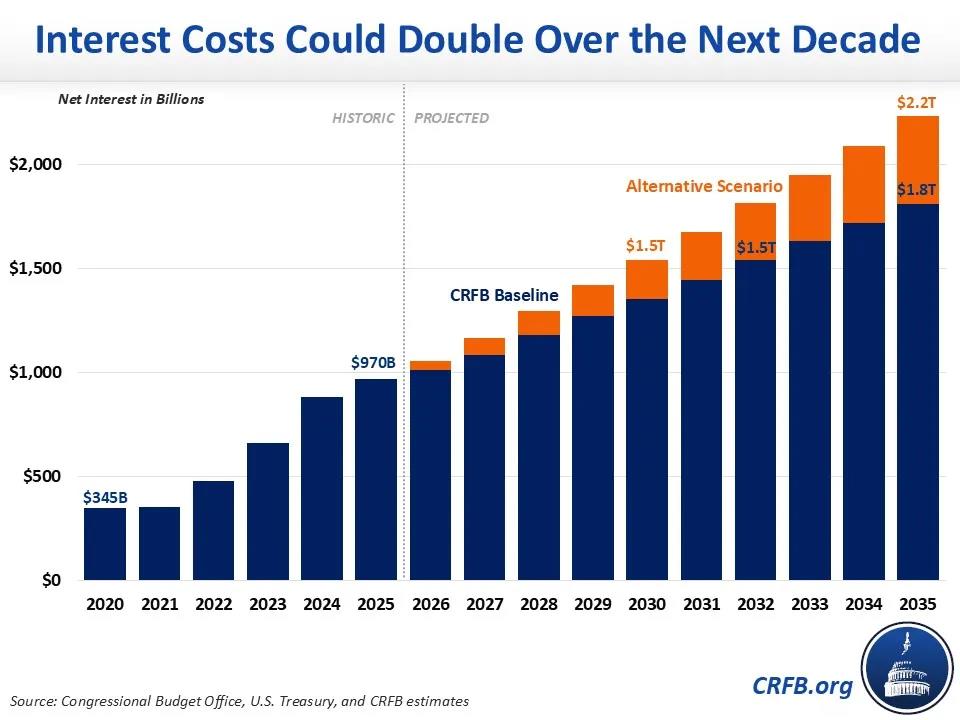

POTUS Donald J. Trump Administration is not yet focused on growth model concerns as it pursues ways to address home affordability before the mid-term election. If the POTUS Trump Administration want to be serious about addressing US growth model and/or home affordability, they should reduce the conforming loan limit in 2026 as it is increasing the limit and its intention just pushes home prices up. That strategy only makes and brings uncertainty into family as basic community structure and the m9ind of the future generation as its demographic’s security.  Meantime, the US public debt outlook is getting worse and worse. Interest costs are projected to nearly double over the next decade, to a record $1.8 trillion. This assumes the US GOV continues to borrow roughly $2 trillion per year that would represent more than 4 times increase since 2021. Under more pessimistic assumptions, interest payments could rise to as much as $2.2 trillion, marking an 450% increase since 2021, as this is staggering. As the national debt continues to climb toward record levels – totalling 100% of Gross Domestic Product (GDP) at the end of Fiscal Year (FY) 2025 – interest on the national debt has also risen significantly. Just five years ago, in Fiscal year 2020, net interest totalled $345 billion … in FY 2025, it totalled $970 billion – nearly three times as large.

Meantime, the US public debt outlook is getting worse and worse. Interest costs are projected to nearly double over the next decade, to a record $1.8 trillion. This assumes the US GOV continues to borrow roughly $2 trillion per year that would represent more than 4 times increase since 2021. Under more pessimistic assumptions, interest payments could rise to as much as $2.2 trillion, marking an 450% increase since 2021, as this is staggering. As the national debt continues to climb toward record levels – totalling 100% of Gross Domestic Product (GDP) at the end of Fiscal Year (FY) 2025 – interest on the national debt has also risen significantly. Just five years ago, in Fiscal year 2020, net interest totalled $345 billion … in FY 2025, it totalled $970 billion – nearly three times as large.  US consumer sentiment is at crisis levels, views on family current financial conditions fell into negative territory for the 1st time in nearly 4 years. In other words, more consumers now describe their financial situation as bad than good. US bankruptcies are running at recession levels, US large bankruptcies rose to 717 in the first 11 months of 2025, the highest reading in 15 years, even large US corporates are struggling to repay their debt. This has never happened outside of US recessions, the US unemployment rate has risen +1.2 percentage points over the last 30 months, to 4.6%, the highest level in 4 years, in the past, such an increase has only occurred during economic downturns.

US consumer sentiment is at crisis levels, views on family current financial conditions fell into negative territory for the 1st time in nearly 4 years. In other words, more consumers now describe their financial situation as bad than good. US bankruptcies are running at recession levels, US large bankruptcies rose to 717 in the first 11 months of 2025, the highest reading in 15 years, even large US corporates are struggling to repay their debt. This has never happened outside of US recessions, the US unemployment rate has risen +1.2 percentage points over the last 30 months, to 4.6%, the highest level in 4 years, in the past, such an increase has only occurred during economic downturns.

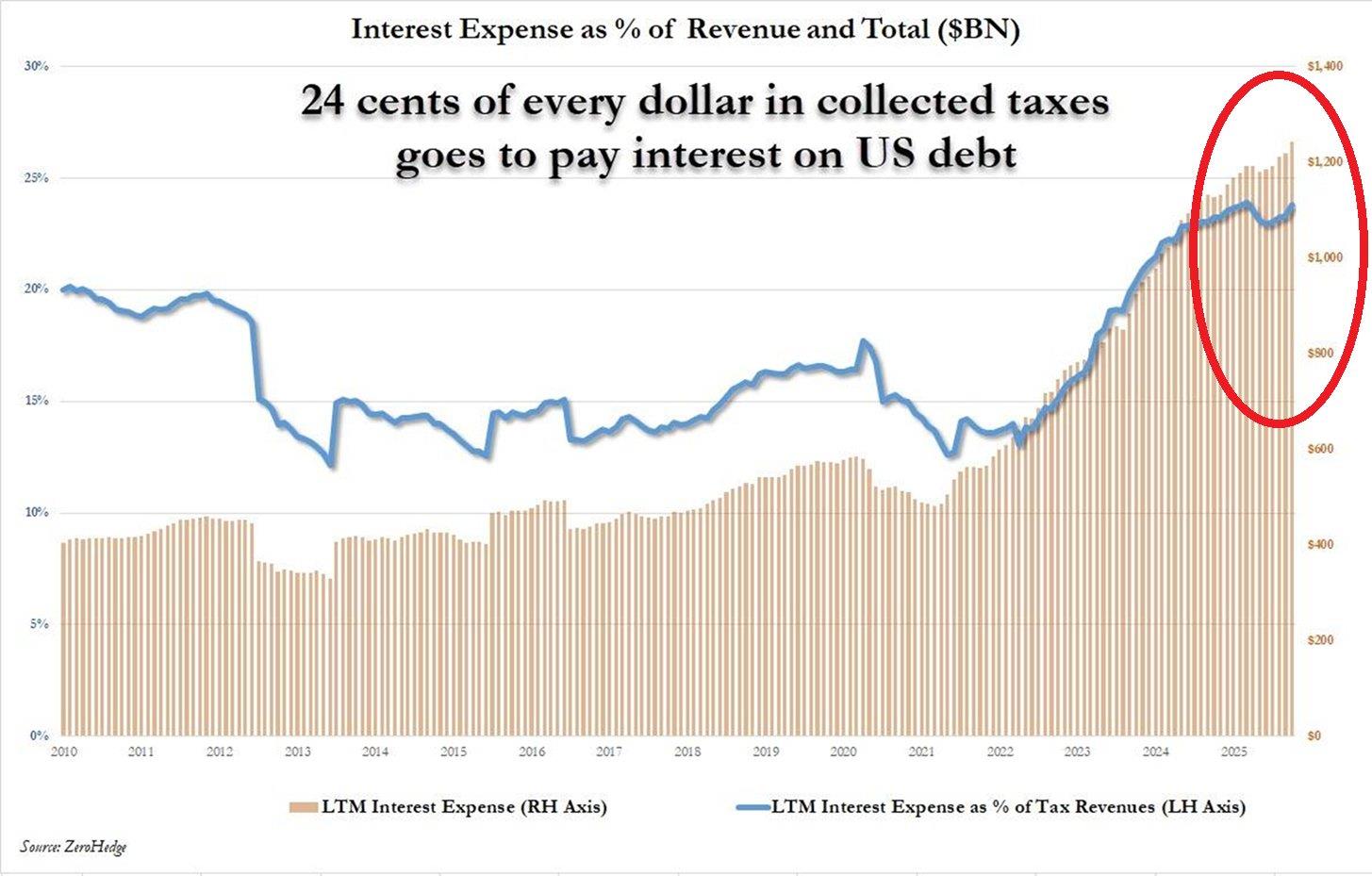

Fiat currencies are in a constant devaluation, 1 US Dollar buys just 0.000066 ounces of gold, an all-time low. This comes as gold prices hit $4,500 for the 1st time. Investing in gold is one of the best hedges against falling purchasing power. The US Dollar is having one of the worst years in decades, the Bloomberg Dollar Spot Index is down over -8% year-to-date, the biggest decline since 2017 and 2nd-largest in at least 20 years, over the same period, the US Dollar Index is down -9.8%. Interest on US federal debt is increasingly eating into the budget, nearly 24 cents of every $1 in taxes collected by the US government now goes toward paying interest on public debt. That is almost twice the level seen in 2021, this comes as gross interest costs have exceeded $1.2 trillion over the last 12 months. That is more than DOUBLE the 2021 amount and QUADRUPLE the level in 2014, the federal government now carries $38.6 trillion in debt as of Dec.31,2025. US budget deficit is at one of the highest levels in HISTORY, in the first 2 months of Fiscal Year 2026, the US government recorded a $458 BILLION budget deficit, the 2nd-largest ever, $284.4 billion was recorded in Oct and $173.3 billion in Nov.

By Peter von Roggenhausen December 28 2025.

Ps. I'm very sorry for the slow action on posting the news; The reason as usually if the fund. We so far did not receive any single penny or red cents in donation. This means that our expenses are covered from the fund we have and loan we have obtain. I have heard some rumors about the donation you have made to US but I can ensure you that such never get to US. So, since we do not accept rumors if you have made any donation ask your band as where it get to? Because we have not received it. Or you can send to US a copy of the donation and we will trace it on your behalf.

Oh. Well, as the people saying "Money talks" ... so if we had had the necessary fund, you will have the right information at the right time.